Sometimes a Cigar is Just a Cigar

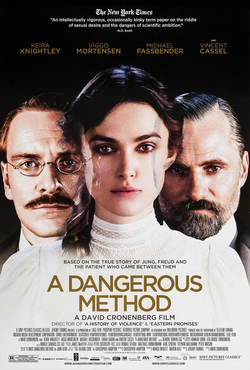

A Dangerous Method is one of those odd films that exemplifies just how complex the notion of British film has become. Produced by Oscar winning British film industry veteran Jeremy Thomas (The Last Emperor, Naked Lunch, Crash), directed by Canada's foremost exponent of Body Horror David Cronenberg, starring Danish-American Viggo Mortensen, German Irish Michael Fassbender and English Rose Kiera Knightly, the film has more producer credits than Freud could wave an oversized cigar at. Listed on IMDB as a Canadian, German, Swiss co-production, shot in Austria and Switzerland, with the support of film funds (government or otherwise) based in all of the above, the first credit that appears on screen is for the BFI.

And, for the life of me, I cannot understand why. The range of funding sources probably goes to show what a brilliant wheeler deeler Jeremy Thomas is, but, it does beg the question why a British production studio which can attract the talents of one of the world's foremost directors, should have to seek funding from Canada, Switzerland and Germany. Maybe this says more about the international nature of film finance and demonstrates that it is possible to make commercial films without Hollywood involvement. A Dangerous Method is currently showing at over 100 screens in the UK and, according to the ever-reliable Wikipedia, has already made more than US$22 million, based on a reported budget of US$20 million. Is this not the sort of project the British film industry should be trying to support?

Adapted by British playwrite and scenarist Christopher Hampton from his own stage play, The Talking Cure, A Dangerous Method tells the (mostly) true to life story of Carl Jung's relationship with one of his most brilliant and troubled patients - Sabina Spielrein, an 18 year-old Russian girl with severe neurosis who would go on to become a doctor of psychology in her own right. The film is also about Carl Jung's fraught relationship with his hero and father figure, Sigmund Freud, the foremost pioneer of psychoanalysis, whoc set the groundwork upon which Jung built his own legacy.What is really exciting, however, is the fact that in the hands of a director like David Cronenberg, what is essentially a period drama can be about more than just the costumes. A Dangerous Method is a story about people and ideas.

The cinematography by long-term Cronenberg collaborator Peter Suschitsky is equisite - early 20th Century Vienna is all beautiful lakes and geometric gardens. Some have complained that the film feels slightly 'stagey', but it is based on a play, and almost all of Cronenberg's best films have been Chamber Pieces of one form or another - The Fly (1986) was essentially a triple header set entirely in one room, with the added attraction of watching Jeff Goldblum transmogrify into a fly, which brings one naturally enough to the film's performances. Goldman was wrongly overlooked at the Oscars in 1986, presumably on the basis that the Academy doen't give awards to genre filmmaking (I love Paul Newman as much as the next guy, but was he really a more deserving recipient for his performance in The Colour of Money?), and the Academy has repeated the trick once again, failing to recognise what I think is one of the best performances of the year. Fassbender and Mortensen are just as assured as one would expect - it might be fairer to flatter their considerable talents, but one can't help buttake for granted that the will be as good as they are. No. The real standout performance is by Kiera Knightley who is superb as Sabina Spielrein - her facial ticks (a worryingly jutting jaw) and bodily contortions are disturbing to witness, Knightly presenting an entirely convincing portrayal of a person under severe mental stress and strain

Once Jung administers the "talking cure" and Spielrein becomes his mistress, the film does loose some of its momentum. Jung's intellectual badanage with Freud about his dogmatic insistence that all psychosis stems from repressed sexual desire - "there must be more than one hinge into the universe", opines Jung - is less engaging than his physical carry on with Spielrein. Here one feels the film might be pulling in two different directions - the interests of the author (Chistopher Hampton) conflicting with those of the director (David Cronenberg). Just as the full erotic potential of the subject matter seems as if it is about to spill over into ecstatic enlightenment the film goes limp and quickly pops its trousers back on. There is little doubt as to which side of the Freud/Jung debate Cronenberg sides with, so it is surprising that he should make something so respectable or conservative. Although, I suppose his hands are tied by the history, at least to a certain degree. It is ironic, but perhaps no surprise, that a film which attempts to give a balanced view of both Freud and Jung should be so conflicted, so schitzophrenic, but that certainly doesn't make it any less fun.

Subscribe to my feed

Subscribe to my feed